Quicken Files Converter

Note: It is not possible to convert QuickBooks data to Quicken. Also, Quicken to QuickBooks data conversion is a one-way conversion. Once a QuickBooks conversion has been performed on your Quicken data, the data can no longer be opened in Quicken. For this reason, you should make a backup of.

This review is for Moneydance 2014 (Windows). I don't think this version is available on Amazon.

You will have to download it online. The purchase price is $50, but the software will let you input 100 transactions to try it out before you have to buy it. I had been a Quicken user since the DOS days of installing it using 5 1/4 diskettes.

I have been looking for alternatives to Quicken for a host of reasons. One of them is the sunsetting policy of their older software every 3 years. As a result, users of Quicken 2011 or earlier have to buy Quicken 2014 in order to continue online banking / bill pay. I'm tired of being forced to upgrade to new software every 3 years to maintain online functionality.

The reviews for Quicken 2014 on Amazon are abysmal, so I don't want to go this route if possible. I have been evaluating Moneydance 2014 for the past few days. I generally like what I see so far.

The migration of data from Quicken wasn't without its problems, but I am working through those issues and I just about have them licked. The biggest problem I have (and it's more my problem than Moneydance's) is overcoming the way Quicken did things and get a good feel for the software. The interface is not as slick as Quicken's but that's not a deal breaker for me. Download of credit card transactions has worked well so far. Still working with the connection to my bank for online bill pay or downloading transactions. I have also been a long time user of Quicken BillPay, but I'm kicking that to the curb also (my bank now offers free bill pay).

There is an iOS app available for Moneydance free of charge. The Moneydance folks are working on an Android app. There is an android app called HandyBank that can interface with Moneydance. The HandyBank app is a bit expensive for an app (about $7). I'll probably just wait for the Moneydance Android app, if I continue with Moneydance. I'm giving Moneydance 3 stars for now.

Overall, I think it's a promising alternative to Quicken and I am leaning towards making the jump. I may update this review as I get more experience with Moneydance. UPDATE 4/23/14 - I have decided to go all in to Moneydance. My trial is almost over and I will go ahead and pay the license fee. I have heard that you can get a discount if you 'like' them on Facebook. I had trouble with migrating about 4 years of data from Quicken Premier 2011 with the balances being way off.

Part of my problem was that Quicken's Year End Copy function did not work for me. I decided to just migrate this years data for all of my accounts which made it easier to figure out where the problems were.

I will keep Quicken 2011 around for a while longer in case I have to access old data. I can update most of my credit card data in Moneydance ok in one step. I cannot update my Lowe's account at all (I couldn't with Quicken either). Fortunately, I don't use my Lowe's cc much, so I just update it manually. I miss the one-click update with Quicken BillPay that I had with Quicken Premier 2011, but Intuit's sunsetting policy and the fact that they no longer give Quicken BillPay customers free updates to Quicken software to maintain BillPay functionality made me rethink my relationship with Quicken.

As I mentioned before, I have ditched BillPay and their $9.95 per month fee in favor of the free bill pay services my bank offers. I don't have one click update with my bank (I can download transactions, then import them), but I'm saving $9.95 per month. There are different Moneydance plug-ins available, like one that you can use to track your stock portfolio.

I have not used it on Moneydance (I didn't use it on Quicken either). I prefer to track what few stocks I follow online.

Moneydance has a decent set of canned reports and graphs, some of which you can put on your home page. There is also a facility to set up reminder (transaction or general) that seems to work pretty well.

The other thing that tipped the scales in favor of Moneydance is the license covers all of the PCs in my household rather than only 3 for Quicken 2014. I go back and forth between 5 PCs that I use for home and work. The data files can be put within DropBox so that all of the PCs are in sync. I will be glad when Moneydance has an Android app (I've heard that one is in Beta). Moneydance in my opinion is a good alternative to Quicken. Not as slick as Quicken.

There are probably some things that Quicken can do that Moneydance can't, but none that I have found that are meaningful to me. Sinve I wrote this review, I found out that a new version was released. And, if you can find the download for it goes a long way towards solving the poor version. If you want to look, make sure you get (at least) release 1175. Still a ways to go, but kudos to the company for approaching the problem and making significant headway.

Do Not, I repeat DO NOT get Moneydance 2015. It is not a production ready system. I have been a loyal Moneydance user since 2004 and until 2015 I would not use any other finance software. Since I was 'forced' to upgrade to 2015, it simply has not worked effectively AND there appears to be no way to go backwards.

The maker, 'InfiniteKind's support is silent on the matter. There a way too many bugs to list all of them, but a few of the critical ones for me are Credit Card Recons do not always work correctly and come up with the incorrect ending balance after accepting the reconcile; reporting does not allow a save of a report from new or previously memorized reports ( I'm having to do my Income Tax reporting by hand, which getting the reporting was one reason to use Moneydance); Tags no longer display a list to pick from and there is no tag editor anymore; the 'show other side' menu item does nothing (and so do many others). Help yourself and DO NOT get this software until they see fit to fix and TEST THOROUGHLY the software.

The version I have is 2015-1100, which is the latest one released for my platform. This review is for Moneydance 2014 (Windows).

I don't think this version is available on Amazon. You will have to download it online. The purchase price is $50, but the software will let you input 100 transactions to try it out before you have to buy it. I had been a Quicken user since the DOS days of installing it using 5 1/4 diskettes. I have been looking for alternatives to Quicken for a host of reasons. One of them is the sunsetting policy of their older software every 3 years. As a result, users of Quicken 2011 or earlier have to buy Quicken 2014 in order to continue online banking / bill pay.

I'm tired of being forced to upgrade to new software every 3 years to maintain online functionality. The reviews for Quicken 2014 on Amazon are abysmal, so I don't want to go this route if possible.

I have been evaluating Moneydance 2014 for the past few days. I generally like what I see so far.

The migration of data from Quicken wasn't without its problems, but I am working through those issues and I just about have them licked. The biggest problem I have (and it's more my problem than Moneydance's) is overcoming the way Quicken did things and get a good feel for the software. The interface is not as slick as Quicken's but that's not a deal breaker for me. Download of credit card transactions has worked well so far. Still working with the connection to my bank for online bill pay or downloading transactions. I have also been a long time user of Quicken BillPay, but I'm kicking that to the curb also (my bank now offers free bill pay). There is an iOS app available for Moneydance free of charge.

The Moneydance folks are working on an Android app. There is an android app called HandyBank that can interface with Moneydance. The HandyBank app is a bit expensive for an app (about $7). I'll probably just wait for the Moneydance Android app, if I continue with Moneydance. I'm giving Moneydance 3 stars for now. Overall, I think it's a promising alternative to Quicken and I am leaning towards making the jump. I may update this review as I get more experience with Moneydance.

UPDATE 4/23/14 - I have decided to go all in to Moneydance. My trial is almost over and I will go ahead and pay the license fee.

I have heard that you can get a discount if you 'like' them on Facebook. I had trouble with migrating about 4 years of data from Quicken Premier 2011 with the balances being way off. Part of my problem was that Quicken's Year End Copy function did not work for me.

I decided to just migrate this years data for all of my accounts which made it easier to figure out where the problems were. I will keep Quicken 2011 around for a while longer in case I have to access old data. I can update most of my credit card data in Moneydance ok in one step. I cannot update my Lowe's account at all (I couldn't with Quicken either). Fortunately, I don't use my Lowe's cc much, so I just update it manually. I miss the one-click update with Quicken BillPay that I had with Quicken Premier 2011, but Intuit's sunsetting policy and the fact that they no longer give Quicken BillPay customers free updates to Quicken software to maintain BillPay functionality made me rethink my relationship with Quicken. As I mentioned before, I have ditched BillPay and their $9.95 per month fee in favor of the free bill pay services my bank offers.

I don't have one click update with my bank (I can download transactions, then import them), but I'm saving $9.95 per month. There are different Moneydance plug-ins available, like one that you can use to track your stock portfolio. I have not used it on Moneydance (I didn't use it on Quicken either). I prefer to track what few stocks I follow online. Moneydance has a decent set of canned reports and graphs, some of which you can put on your home page. There is also a facility to set up reminder (transaction or general) that seems to work pretty well.

The other thing that tipped the scales in favor of Moneydance is the license covers all of the PCs in my household rather than only 3 for Quicken 2014. I go back and forth between 5 PCs that I use for home and work. The data files can be put within DropBox so that all of the PCs are in sync. I will be glad when Moneydance has an Android app (I've heard that one is in Beta). Moneydance in my opinion is a good alternative to Quicken. Not as slick as Quicken.

There are probably some things that Quicken can do that Moneydance can't, but none that I have found that are meaningful to me. Sinve I wrote this review, I found out that a new version was released.

And, if you can find the download for it goes a long way towards solving the poor version. If you want to look, make sure you get (at least) release 1175. Still a ways to go, but kudos to the company for approaching the problem and making significant headway. Do Not, I repeat DO NOT get Moneydance 2015. It is not a production ready system.

I have been a loyal Moneydance user since 2004 and until 2015 I would not use any other finance software. Since I was 'forced' to upgrade to 2015, it simply has not worked effectively AND there appears to be no way to go backwards. The maker, 'InfiniteKind's support is silent on the matter. There a way too many bugs to list all of them, but a few of the critical ones for me are Credit Card Recons do not always work correctly and come up with the incorrect ending balance after accepting the reconcile; reporting does not allow a save of a report from new or previously memorized reports ( I'm having to do my Income Tax reporting by hand, which getting the reporting was one reason to use Moneydance); Tags no longer display a list to pick from and there is no tag editor anymore; the 'show other side' menu item does nothing (and so do many others). Help yourself and DO NOT get this software until they see fit to fix and TEST THOROUGHLY the software. The version I have is 2015-1100, which is the latest one released for my platform. I've spent the past week trying out various Mac products in hopes of being able to get off Quicken, which requires me to maintain Windows and Parallels in addition to Quicken - a real nuisance.

After the first day I was very discouraged and almost gave up. The first hurdle, importing Quicken data from numerous accounts going back to 1995, was too much for most of the products. Only iBank got it mostly right the first time. My initial notes on Moneydance mentioned several feature deficiencies as well as inability to import the data correctly. I am glad that I stayed with it.

I realized that I made some mistakes in my Quicken export, and after some minor tweaking I got all the data from 11 bank, investment and credit card accounts into Moneydance and reconciled, with downloads working. (Even after I fixed my mistakes, the other products except for iBank have still not been able to import the file). Although the documentation is not great, the support on their website is; their support team is very responsive, and I easily found the answer to every question I had just by searching through the questions previously posted by other users.

Little by little I found that most of the features I thought were missing are actually there. Maybe some things could be more intuitive, but that's not important - for a piece of software that I will use every day, I can invest some time in learning how to use it. I like the customizable home page.

I have my accounts, my expenses and budget in graphical form, a calendar and my reminders, which is a feature I'm finding very useful. I also have a third-party budget extension called Money Pie which I haven't explored yet but which looks pretty awesome. I have not tried out everything. There is a third-party Android application for Moneydance called Handybank that I have not tried yet, and they have their own mobile application for the iPhone. Dropbox is used for syncing.

I tried to set up online Bill Payment and couldn't get it to work, but I imagine it's resolvable; I don't really plan on using it and only tried it out of curiosity. There is also a check printing feature that I have not tried. IBank would have worked for me too. Neither product is as good as I would like in investment reporting and tools - nor Quicken, for that matter - but Moneydance is better. The thing that makes Moneydance the clear winner is that it's a cross-platform product, with a published API and developer toolkit that allows anyone to develop extensions. A number are available and I hope there will be more in the future. If I really needed something I could take a stab at it myself.

Although they won't announce a date or what's in it, the 2013 release seems to be imminent, so I am waiting for it before I buy. The company seems to have a history of making major improvements with each new release, so I am looking forward to seeing what they've added. Meanwhile, I am overjoyed that I can finally see an end in sight to needing Quicken. I am going to run both for a while until I'm certain, but it's looking very good. Used Ibank, Moneywhiz for a long time - tried countless others with Moneydance I have real visibility and control of my finances - usually with PF apps, 1 module is a flop, whether its budgeting, cashflow, or reporting - but with this app everything is there and everything is good and works. I've been using MD for a year, having migrated from Windows to Mac and hoped this would be a replacement for the Quicken I was using on my Windows machine.

I am using the very simplistic budgeting feature in MD which is awkward at best to set up but I muscled through it. Now, when I view the budget against actual for the past 10 months, the report is dropping transactions from the actual column. Support had been non-responsive for weeks, and now I have someone's attention who claims to 'see if we can figure out what's going on, so we'll be getting back to you soon.' That was 10 days ago.

Nothing since. I don't know about you, but when a system drops transactions from a report, all reports are suspect and therefore can't be relied upon. It's extremely difficult to operate this way and I'm looking for a replacement financial management software to start using in the coming year Why no voting buttons? We don't let customers vote on their own reviews, so the voting buttons appear only when you look at reviews submitted by others. I'm an ex-Quicken (5 years) and Money (10+ years) user. I looked for an alternative to Q2014H&B after its latest forced 'upgrade' caused it to crash on 'One Step Update'.

No amount of 'patching' helped, nor did the eventual 'forced' purchase I made of Q2016H&B - it crashed immediately after every attempted 'clean' install; again, patching did not work. I'd made no changes to my computer setup prior to the earlier version's 'upgrade' or the latter's installation. And yes, I have enough computer savvy to understand file management, register entries, use of 'deep' uninstaller apps, etc.and read enough Q user posts to know the root problem lies with Q and not me.

Enough said about Q. I place greater weight on function rather than form. I was looking for a computer-based, personal financial accounting app that would remind me when bills are due, enabled basic budgeting, monitored cash flow and allowed (at minimum) the manual downloading of account transaction information from third-party websites. MD does all that. I'd recommend installing the free crippled version (limit of 100 transactions) of MD and test driving it. The number of transactions are limited but in all other respects the free version appears to be fully functioning.

I created a couple of credit card, checking, auto loan and a mortgage loan accounts. I had no trouble manually downloading and installing transaction data (in QIF format) for any of them. I was able to create a triple split transaction for my mortgage payment (principal, interest, escrow) and dual split transaction for the auto loan (principal and interest). Transaction and reminder entry is basic and straightforward.

Note that if you are migrating from Q you must export your data from Q directly in.QIF format as MD cannot read from a backup file (QDATAMNY.QDF). But nor can any other app for that matter. MD is what it is. If you have familiarity with basic accounting and the logic behind simple app structure you will not have too many problems running MD through its paces, assessing its attributes and limitations and determining if it's right for you. Its UI harkens back to very early MS Money and by today's UI standards it is 'Old School' grade. Not much personalizing allowed and the interface IMHO is homely but not butt-ugly. You can set up your primary page to display what information (as dictated by MD), you consider important.

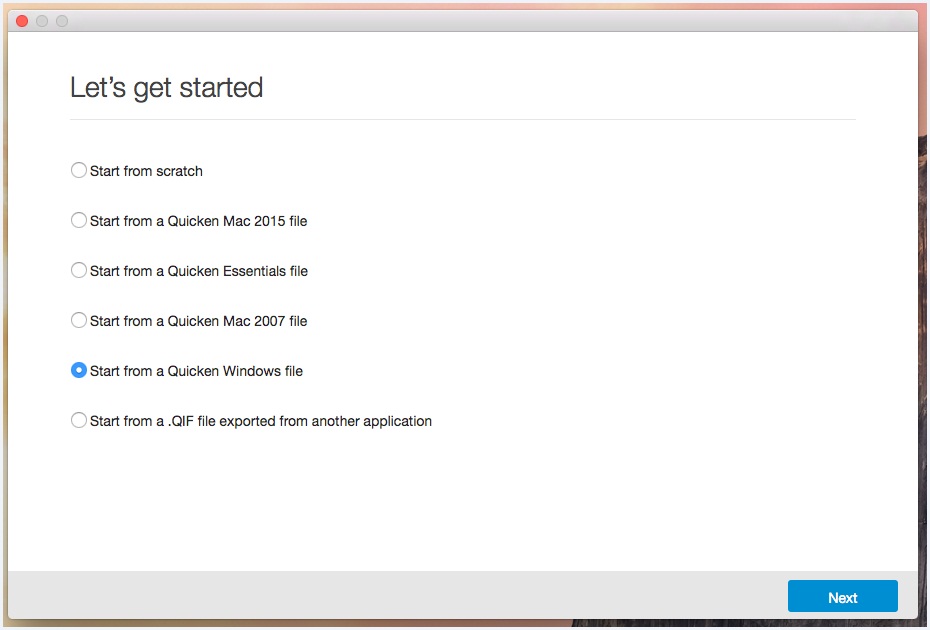

Quicken File Converter

Functionally, it performs the core functions it promises. Again, more sophisticated investors will likely want additional apps dedicated for investment tracking and prognostication. Some important features don't work on windows 7 64pro, and 8.1 (tried 32 and 64 bit installation file (attaching file to transaction, and editing budget does not work).

Even with the help of the original file and video of me trying to create a budget and add items to it, tech support could not solve problem. I even put a fresh install on a different computer and created a new moneydance file and the feature still didn't work with the build they said 'works for everybody else'. I'm coming from MS Money 2003 Deluxe and it is superior to MoneyDance 2015 Build 1111. I was looking for more options in managing text size, the home page layout, and account grouping (all graphics), and ability to use it on Mac.

I also wanted to keep all the existing features of MS Money Deluxe 2003 The only thing nice about moneydance is it's colorful and you can control text size easy.other than that it is a huge waste of time.very frustrating. OPTIONS IVE LOOKED AT.prerequisites -Needed to be available on windows and mac -not require online access -ability to adjust text size (no need to squint or jack up your system display settings, or use accessibility when text size offset can be added to software.moneydance did a great job with this) -have all financial and budget tools common to MS Money or Quicken (credit card (balance, max credit, APR comparison), interest rates and loan management, amortization, mortgage, escrow management, etc) If it's not listed below it probably doesn't have the necessary prerequisites. If you know of one that has the above prerequisites please list it in the comments. Kmymoney doesn't have good graphics but all the important stuff for account and budget management works.and it is free (and works on Windows, Linux, and Mac). Quicken has no trial and with the number of poor reviews I don't want to fork over money to see if it works as expected and then wait to get my money back if it doesn't work.(from their website.'

Refunds are typically applied within 2 - 3 days. Depending on your financial institution's process, this could take up to 10 days', or if you buy cd 'Refunds are typically applied within 3 - 4 weeks from the time Intuit receives the returned product at our warehouse') Plus you have to pay for a separate licence if you want to use it on your Mac if you purchased the PC version. YNAB is just for creating and following budget.not for managing things like credit cards, mortgage escrow, amortization, bank interest, etc. $60 is a lot of money for pretty budget software that doesn't do much else. If you just want to simply budget (how much is available and how much you spent) YNAB is probably the best on the market for you. Watch their video so you understand what the software primary feature objective is).

The best for cash budgeting for kids in my opinion. Not a good option when you start managing complex assets/liabilities like credit cards, loans, 401Ks, etc, unless you don't care about important considerations that are attached to those transactions. What's funny is a LOT of their users care about the important things attached to complex assets and liabilities and spend hours trying to manipulate YNAB software to accommodate their needs. Clearly YNAB hasn't done the amazing job they boast about on their advertising page where they compare themselves against MS Money. It's like comparing fruits to vegetables. Both do a good job at something but neither do the whole job.

And clearly consumers are having a difficult time finding budgeting software like YNAB and Money Management Software like MS Money/Quicken rolled into one. Again.moneydance is the closest I know of.

Fortora Fresh Finance Software has no customer support. I tried to contact them before downloading their trial because I saw the complaint from paying customers. I wasn't able to get in touch with them either.

So since they never answered my question about licence keys working on windows/mac and if they force upgrades.i ruled them out. Money Manager EX.still evaluating Again, If it's not listed below it probably doesn't have the necessary prerequisites. If you know of one that has the above prerequisites please list it in the comments. It loads in 8.1 - it seems to work - but there are certain unacceptable flaws. It will not, for example, import a Discovercard statement (or, presumably, other credit card statements, although version 2010 had no problem doing so). You can calibrate your printer for the checks you use, but the next time you open the program, you find it's lost all the settings. And all this in July 2014 - 7 months after Windows 8.1 was introduced.

(A year after 8.1 beta.) There's zero support as well. You can send them an email asking what to do, but don't expect an answer.

There is no phone number. I'm especially unhappy because I spent two hours with the new version, paying bills, reconciling accounts only to bump into the Discovercard problem. Then I couldn't find a way to go back to the old version (which I am forced to run on my Windows 7 laptop) without retyping everything I did. So another 45 minutes of my life I won't get back. I've used Moneydance for 3 or 4 years with Windows XP and Windows 7 and liked it.

But then I upgraded to Windows 8.1 and I'm out of luck. Unfortunately, I didn't buy from Amazon - I downloaded the upgrade direct.

I've asked for a refund but, again, they don't answer their emails. Ituit can be a pain to deal with, but at least you can deal with them. I'm going back to Quicken.

I was really disturbed by the number of bad reviews for Quicken 2014 and even more disturbed by the fact that a lot of the good reviews look fake - the only review that user ever made? So I did some research and downloaded MoneyDance 2014.

I am still evaluating it, but it looks like it should be a viable Quicken replacement. It pulled in about 15 years worth of Quicken data - which is probably more than Quicken could do. We have had recommendations from Quicken Support to delete all but the last year worth of data when we had a problem a couple of years ago.

Online operations are too easy - it sends bill payments in as you enter them, and downloads seem faster than Quicken. It pulled all the payees and categories from the Quicken export files.

Like I said, I am still learning the product, but I really don't see the point of going back to Quicken. First the sad Quicken saga: Even before ('Quicken 2007'), Intuit was milking the Mac cow for profits with virtually no upgrade in features over the previous several versions. It was powerful and handy - a 5-star product but for its stability and obsolesence issues.

It will no longer run under the next OS version, to be released in mid-2011. It was the last full-featured version of Quicken for the Mac. It had most of the features of the Windows version - call it Quicken 'classic'.

Quicken 2007 became dangerously unstable in my experience. I had relied on successive versions of Quicken 'classic' from 1992 to 2011. In the last several years, it would crash or hang, corrupting my data. I had to track securities cost data using old statements and spreadsheets. Was first released in 2010 - all new code, slowly built from the ground up for the Intel processors Apple introduced in 2006 (Rosetta not required). Very limited feature set - promising if you wait 1 to 3 more years. Intuit is very slowly releasing expanded versions (as free upgrades).

As of late 2010, it's totally inadequate for securities owners (example: doesn't track cost basis by lots). Quicken Essentials lacks many other important features found in Moneydance, other Quickens and other financial software.

I switched to last month and I'm very pleased:. Stable and well-supported by its developers. Tracks securities just fine. Importing 2 decades of Quicken data worked well and quickly (follow their simple instructions exactly). Some inter-account transfers needed correction afterwards; this was straightforward.

My corrupted Quicken securities data was automagically healed after importing. The interface is a little different from Quicken Classic - better in some ways, not as good in others. As of late 2010, other Quicken competitors such as just didn't match Moneydance in my evaluation. IBank seems the most popular alternative but its developer has been heavily criticized for inadequate support.

CSV2QFX Converter is a simple software application which enables you to easily transform CSV bank, credit card or investment information to a format suitable for Quicken, namely QFX. The installation does not offer to download or add other third-party products, and it is over in a few seconds. However, if you want to bypass this process and run this tool from a pen drive, you should know there is also a portable version,. The interface can only be characterized by simplicity, as it only displays a menu bar and a pane to display logs. Anybody can find their way around it, even people with little or no experience whatsoever with computers.

CSVs can only be uploaded to the utility by using a file browser, as the “drag and drop” function is not integrated, and you should know the conversion process is performed automatically. The results are going to be saved in the same location as the original file. It is possible to preview items in a new window, and you can specify exactly what type of information each column contains. Logs can be saved to the hard drive as LOG files, and dates can be read in the US format (month-day) or the Euro one (day-month). This program does not affect your computer’s performance, as its usage of CPU and memory is insignificant. This means you can run it alongside other processes without encountering problems. Taking all of this into consideration, we can safely say CSV2QFX Converter is a simple solution for people interested in converting CSV files to QFXs, with a good response time and minimal design.